Snapchat Reaches 850M Users, Improves Ad Revenue Performance

Snapchat has published its latest performance update for the second quarter of 2024, showing increases in both users and revenue, as it continues to drive improved performance for its ad business.

Though its costs also continue to rise, and there’s no mention in its report of new products, like an advanced version of its Snap Spectacles glasses. But maybe Snap’s just saving that for its Partner Summit, which is coming up next month.

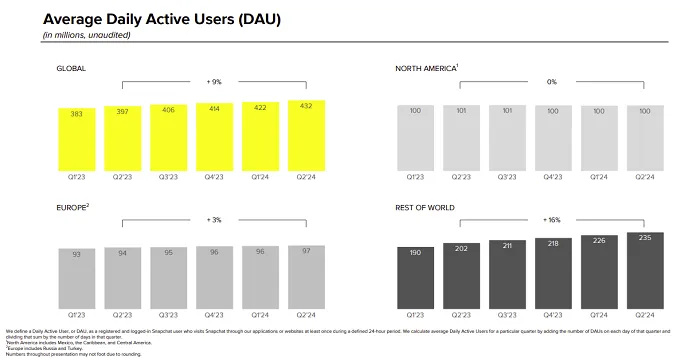

First off, on users. Snapchat added 10 million more daily actives in the period, taking it to 432 million DAU.

Which is an impressive number. For comparison, X currently serves 250 million DAU. So while the platform formerly known as Twitter is more widely discussed, and arguably better known among the general public, Snap actually has almost twice as many users.

Though it is important to note where that growth is coming from.

As you can see in the above charts, Snapchat added virtually no new users in the U.S. and Europe, which have long been its key revenue markets.

Snap recognized this in its Q1 report, noting that it would be making more effort to grow its business in its key revenue economies, though it’s interesting to see that Snap is building its business in other regions.

As you can see in these charts, Snap generated $1.24 billion for the quarter, with the “Rest of the World” category now exceeding Europe in revenue intake.

Snapchat still earns more per user in EU, but the sheer volume of users in these other markets is increasing its earnings potential. So while the U.S. and Europe remain its most lucrative markets, it is also growing its opportunities significantly in other places.

In addition to its 432 million DAU, Snapchat has also now reached a new monthly user milestone of 850 million, which is another key growth signal for the app.

In terms of usage, Snap says that it saw “all-time highs in the number of daily active users sending Snaps in every region,” underlining the potential of Snaps to connect user communities. Snap also says that global time spent watching content in the app has grown 25% year over year.

Snap’s investing more into AI tools and AR effects, helping to drive more engagement, with its Gen AI Lens “Scribble World” being viewed over a billion times in the quarter.

Though that development also comes at a price.

As you can see in these charts, Snap’s infrastructure costs continue to rise, while it’s also now spending more on advertising and promotion, in line with that push to drive more interest among U.S. advertisers.

Snap is making progress as a result, in building larger, more responsive AI models, which have also been key to driving improved ad performance. But it is an element to watch as the platform evolves.

On another front, Snapchat+, its subscription offering, is now up to 11 million subscribers, rising from 9 million back in April. While Elon Musk’s changes at X have mostly failed to resonate with users, it is interesting to see how his decision to push subscriptions has benefited other apps, with Snapchat+ being the most successful of the new wave of social subscription offerings.

Overall, it’s a good report for Snap, which shows significant opportunity in its ad business and continued high usage. The lack of growth in its key markets is a concern, but the fact that Snap is now capitalizing on other opportunities also bodes well.

So now, we just need to see what’s coming next from the app.