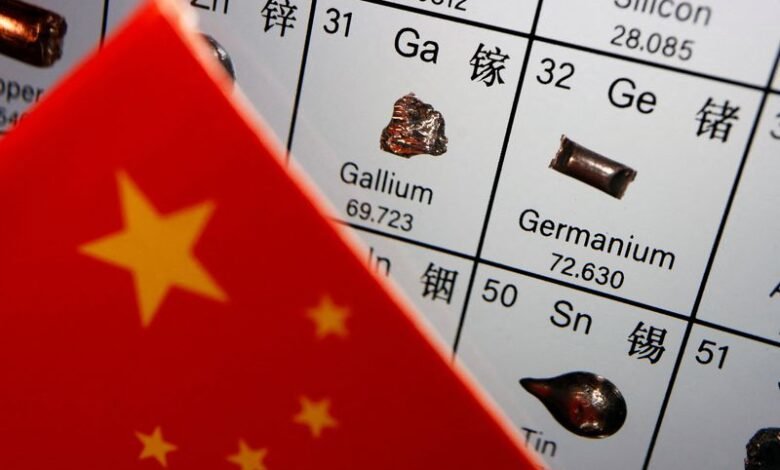

Global alarms rise as China’s critical mineral export ban takes hold

By Jarrett Renshaw and Ernest Scheyder

(Reuters) – Alarm over China’s stranglehold on critical minerals grew on Tuesday as global automakers joined their U.S. counterparts to complain that restrictions by China on exports of rare earth alloys, mixtures and magnets could cause production delays and outages without a quick solution.

German automakers became the latest to warn that China’s export restrictions threaten to shut down production and rattle their local economies, following a similar complaint from an Indian EV maker last week.

China’s decision in April to suspend exports of a wide range of critical minerals and magnets has upended the supply chains central to automakers, aerospace manufacturers, semiconductor companies and military contractors around the world.

The move underscores China’s dominance of the critical mineral industry and is seen as leverage by China in its ongoing trade war with U.S. President Donald Trump.

Trump has sought to redefine the trading relationship with the U.S.’ top economic rival China by imposing steep tariffs on billions of dollars of imported goods in hopes of narrowing a wide trade deficit and bringing back lost manufacturing.

Trump imposed tariffs as high as 145% against China only to scale them back after stock, bond and currency markets revolted over the sweeping nature of the levies. China has responded with its own tariffs and is leveraging its dominance in key supply chains to persuade Trump to back down.

Trump and Chinese President Xi Jinping are expected to talk this week and the export ban is expected to be high on the agenda.

Shipments of the magnets, essential for assembling everything from cars and drones to robots and missiles, have been halted at many Chinese ports while the Chinese government drafts a new regulatory system. Once in place, the new system could permanently prevent supplies from reaching certain companies, including American military contractors.

The suspension has triggered anxiety in corporate boardrooms and nations’ capitals – from Tokyo to Washington – as officials scrambled to identify limited alternative options amid fears that production of new automobiles and other items could grind to a halt by summer’s end.

“If the situation is not changed quickly, production delaysand even production outages can no longer be ruled out,” Hildegard Mueller, head of Germany’s auto lobby, told Reuters on Tuesday.

Frank Fannon, a minerals industry consultant and former U.S. assistant secretary of state for energy resources during Trump’s first term, said the global disruptions are not shocking to those paying attention.