Elon Musk Just Gave Super Micro Computer and Dell Investors a Reason to Cheer

One of the biggest themes in the markets for the last two years has been artificial intelligence (AI).

Naturally, famed entrepreneur Elon Musk has found himself at the center of the AI revolution — and he just gave investors a big reason to seriously consider both Dell Technologies (NYSE: DELL) and Super Micro Computer (NASDAQ: SMCI).

Let’s explore how Musk is working with these AI leaders, and assess if these stocks are good buys right now.

What did Elon Musk just say?

In addition to running Tesla and social media platform X (formerly Twitter), Musk is also managing an AI start-up, called xAI.

xAI is building a chatbot called Grok, and is aiming to compete with the likes of OpenAI. Musk is a co-founder of OpenAI but abandoned the project back in 2018. Since his departure, Musk has gotten into many publicized tiffs with OpenAI’s CEO, Sam Altman, over safety concerns and how AI should be used in society.

In early June, Musk revealed that xAI will be utilizing a series of AI chips from Nvidia. The entrepreneur followed up this announcement with another exciting development.

Namely, Musk took to X to tell investors and AI enthusiasts that xAI will be partnering with Dell and Supermicro to build its AI infrastructure such as server rack solutions and factory architecture.

How Dell and Supermicro stand to benefit

AI has many different components. One of the biggest bellwethers for AI at the moment are specialized chips known as graphics processing units (GPUs). These chips are used to train large language models and other computing functions to develop generative AI applications.

Right now, Nvidia is the undisputed leader of AI chips — owning an estimated 80% share of the market.

However, deploying chips into machine learning models and other use cases is only part of the broader equation. Companies such as Dell and Supermicro specialize in a different area within the chip realm.

Both Dell and Supermicro are major players in AI infrastructure solutions. Essentially, both companies specialize in designing integrated systems architecture, server racks, and storage clusters for data centers.

Considering xAI just raised $6 billion in funding back in May, Dell and Supermicro appear well positioned to benefit from AI tailwinds as xAI moves swiftly to catch up with the competition.

Dell, Supermicro, both, or neither?

On the surface, owning different businesses across the semiconductor landscape might be a good idea. AI is still in its infancy, and there are many different applications among chip companies that are playing a role in the technology’s development.

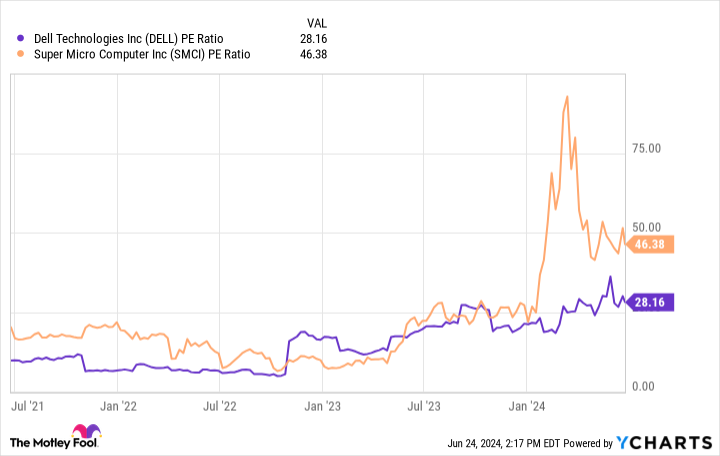

With that said, a close look at valuation should shed some light on investing in Dell and Supermicro in particular.

The chart above illustrates the price-to-earnings (P/E) multiple for Dell and Supermicro over the last few years. While neither stock looks cheap, Dell is clearly trading at a noticeable discount to Supermicro. With that said, Supermicro’s premium is arguably warranted considering how fast the company is growing.

Moreover, one of my biggest knocks against Supermicro has been that the company relies heavily on business from Nvidia — a dynamic that could hurt the company in the long run as more companies design competing chips.

Now, with a nod of approval from Musk and xAI, I’m more optimistic about Supermicro’s prospects of branching out and earning meaningful business from new customers in the AI space.

At the end of the day, allocating a portion of your AI holdings to both Dell and Supermicro could be a good idea for long-term investors. If I had to just choose one company, I think Dell is the better value compared to Supermicro based on its lower P/E and diversified business. Considering Supermicro is still relatively small, I think its valuation needs to continue normalizing before it looks like a bargain opportunity.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $759,759!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Adam Spatacco has positions in Nvidia and Tesla. The Motley Fool has positions in and recommends Nvidia and Tesla. The Motley Fool has a disclosure policy.

Elon Musk Just Gave Super Micro Computer and Dell Investors a Reason to Cheer was originally published by The Motley Fool