FINANCE

-

Stellantis offers voluntary redundancy scheme at Turin plant

(Refiles to fix typo in plant’s name) MILAN (Reuters) -Stellantis has started a voluntary redundancy plan for 610 workers at its Mirafiori plant in Turin, Italy, after introducing the scheme at other Italian facilities, the automaker said on Monday. Stellantis is so far cutting up to 1,600 staff in total across Italy this year through the voluntary redundancy scheme. At…

Read More » -

Make US lenders ‘safe to fail’

The Federal Reserve’s new top banking cop Michelle Bowman said Friday she wants to revisit bank regulations made in the wake of the 2008 financial crisis so that risk is “effectively managed” and lenders can fail without hurting the economy. In her first remarks since being confirmed this week as the new vice chair of supervision at the central bank,…

Read More » -

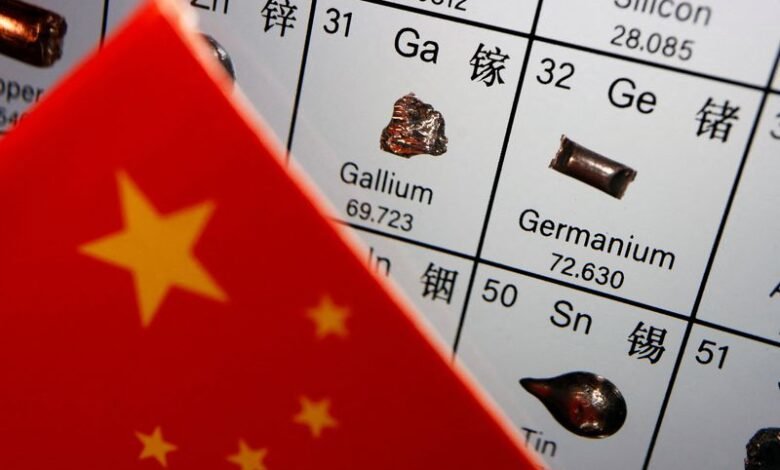

Global alarms rise as China’s critical mineral export ban takes hold

By Jarrett Renshaw and Ernest Scheyder (Reuters) – Alarm over China’s stranglehold on critical minerals grew on Tuesday as global automakers joined their U.S. counterparts to complain that restrictions by China on exports of rare earth alloys, mixtures and magnets could cause production delays and outages without a quick solution. German automakers became the latest to warn that China’s export…

Read More » -

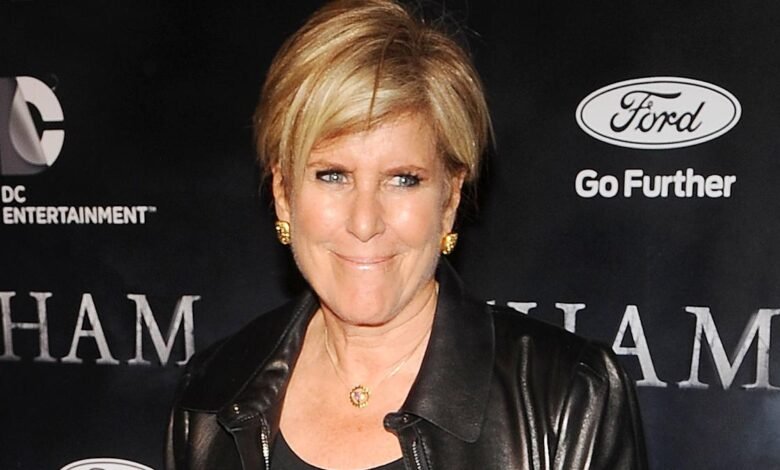

5 Types of Investments Poised To Benefit

Suze Orman is feeling optimistic about the stock market. On a mid-May episode of her “Women & Money” podcast, she predicted that the market could “absolutely skyrocket” through the end of 2025 and into early 2026, despite short-term volatility. In her view, long-term investors should avoid fear-based selling and instead focus on building wealth through smart, diversified investing. Advertisement: High…

Read More » -

What is property damage liability insurance, and how does it work?

Property damage liability insurance pays for car accident-related damage you cause to other people’s property. Since it’s a required coverage in most states, you likely already have it if you have an auto insurance policy. It’s important to understand property damage liability insurance so you can decide if you have enough coverage in case you cause a crash. Learn more:…

Read More » -

The bad economic vibes are causing more people to stock up on gold

ROMAIN COSTASECA/Hans Lucas/AFP via Getty Images Bad vibes in the economy are making gold a more attractive investment. Demand for physical gold jumped 13% in the first quarter, according to the World Gold Council. Gold dealers say clients are worried about the dollar’s decline, a debt crisis, and other scenarios. Marc Faber, a longtime investor who says his nickname is…

Read More » -

How these two major credit scoring models compare

When you apply for a credit card or loan, creditors need a quick way to determine if you’re trustworthy. How do they do it? Before the invention of credit scores, they had to get creative. Creditors relied on anything from letters of recommendation to financial background checks, and some just used their personal judgment. Thanks to FICO, things have changed.…

Read More » -

Regeneron buys bankrupt 23andMe for $256m

23andMe has found itself a buyer after biotech Regeneron won an auction to buy the bankrupt genetics company for $256m. As part of a court-supervised sale, the auction will see Regeneron acquire the majority of 23andMe’s assets. This includes the company’s Personal Genome Service (PGS) and Total Health and Research Services business lines, but not the Lemonaid Health subsidiary. Lemonaid…

Read More » -

BMW Group Plant Landshut enhances digitalisation in production

The BMW Group is enhancing digitalisation in its component production, with the Landshut plant using AI-supported data analysis to detect anomalies and prevent cyberattacks. The plant employs digital process control and networked production facilities to improve productivity and quality. BMW Group Plant Landshut head Thomas Thym said: “We not only implement technical progress, but also actively shape it in order…

Read More » -

Goldman is assembling a growing arsenal of AI tools. Here’s everything we know about 5.

Getty Images; Jenny Chang-Rodriguez/BI Goldman Sachs has been building out its generative AI toolkit. The firm aims to release one of its tools, an AI assistant, to most staff this year. Here’s a look at five such tools — the promise of what they can do, plus who’s using them and how. Last summer, Goldman Sachs’ tech chief, Marco Argenti,…

Read More »